AML & ATF Compliance for Money Service Businesses

The competitive world of foreign exchange business and new regulatory environment, have created an increasing pressure on MSB and exchange bureaus to conform to new government and banking regulations to deploy automated record keeping software systems.

CurrencyXchanger was designed with the help of industry specialists with robust features to meet all these challenges, and enable foreign exchange companies like yours to become compliant with such regulations. If you are new to this business or would like to learn about the regulations, feel free to contact us and we will guide you in the right direction.

Why Banks Close Money Exchangers and MSBs Bank Accounts?

If you are not aware of it, there has been an increasing trend about banks, credit unions and other financial institutions closing down the bank accounts of MSB (Money Service Businesses). This phenomenon is more prevalent in the US and Canada, but have been followed in other countries too.

The general impression is that banks are trying to kill their competition by eliminating their ability to bank. Although that may seem like a valid perception, it is not the general purpose of this practice. The reason boils down to risk vs. benefit management. MSBs are inherently "high risk" as they can involuntarily help facilitate money laundering and terrorist financing through lack of proper systems and processes in place.

There are more than one factor or two that determine the risk score of an MSB. Banks have to go through a very long and thorough process of risk-assessment to evaluate the capacity of an MSB in terms of fighting money laundering and terrorist financing.

Every bank has a different way of evaluating their customers, but most share some common criteria. These are some of the issues that could influence the bank's decision:

- Computerized AML Compliant Record Keeping System (the system that you are using must be compliant with regulations). MSBs that are using manual record-keeping system will have a zero chance to keep their accounts.

- Number of branches that you have (the higher, the riskier). If you run a multi-branch operation, you must have a way to consolidate the data between your branches and report suspicious aestivates.

- Your management should be aware and trained on all the regulations for AML and ATF. You should keep and provide evidence of your management training in regulatory safeguards, record-keeping and reporting.

- The variety of services that your MSB offers (remittance, cash, cheque cashing, dealing precious metals, etc...); more services is usually riskier. As the bank will have to report your MSB's transaction to your regulator, they want to know how much reporting cost you will bring them.

- AML (Anti-Money-Laundering) & ATF (Anti-Terrorist Financing) program in place (manual of AML and ATF custom-made for your business). Your compliance manual should mention how you will perform your KYC, KYA (Know Your Agent) , KYE (Know Your Employee) , 24-hr rule, sanction list checks every time you deal with recurring clients. A generic compliance manual will not be acceptable by the banks anymore.

- Background checks against sanction lists: must be automated, they will not believe that you will ever do this manually. Your list must be updated at least weekly.

- Reporting program. Please keep all records of your reporting.

- As an MSB, you are prone to having suspicious transactions. You must keep the evidence and provide it to the bank.

- Interview: you will be interviewed and the branch manager will put their own recommendation. Some interviews are unofficial and may be done over the phone. You should be very well prepared to answer questions from the bank regarding your compliance program.

- Training program: you should have regular compliance training program for your staff. Keep a record of all training and provide to the bank as proof of your training program in action.

- Internal Audit program: You must mention in your compliance manual that you have provisioned an internal risk-assessment program

- External Risk Audit: You may be required to do an external audit by auditors such as Grant Thornton, KPMG, Ernst & Young, or other.

AML Compliant Software - CurrencyXchanger

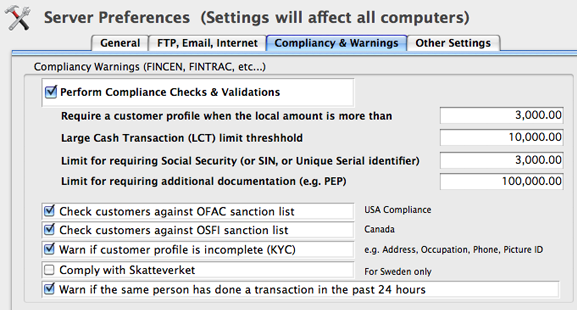

CurrencyXchanger has provisions for AML compliance that can be configured for different countries based on the local laws. The preference setting allows different thresholds to be set for different transactions. Furthermore, the managers can configure the software to stop the user from continuing a transaction or simply allowing them to continue.

Screening Names of Entities and Individuals against Sanction Lists

CurrencyXchanger can automatically cross-reference the name of all entities recorded in the system against the consolidated list of names and entities that have been blacklisted by AML authorities.

If a match is found against any of the sanctioned lists, a dialog box will pop up to display the origin of the match. The system will automatically block the transaction until proper due diligence is complete by the teller or the person recording the transaction. The system will warn the user several times before the transaction can be completed.

Preparing for your AML audit

For your next AML Compliance audit make sure you have the following documents in order:

- Updated Compliance Manual (Compliance Regiment)

- Compliance Training Log Book (Proof of AML training for you and your staff)

- Corporate customers documents should be complete (registration, shareholders structure, etc: as per FINTRAC or your ligislatory requirement)

- Customer information (KYC due diligence) should be complete and entered in your electronic record-keeping system (e.g. occupation, address, DOB, etc...)

- Prepare the selected queries (as requested in the auditor's letter) for them in advance

- Prepare your staff for personal Interviews and ask them to review their material

- Compliance officer will be Interviewed (Record Keeping, Legislation...)

- Methods of Risk Assessment for your customers (how to determine high risk customers)

- It is recommended to have your F2R reports ready and have the confirmation numbers entered in your electronic system